iowa transfer tax calculator

Real Estate Transfer Tax Calculator Hamilton County Iowa Real Estate Transfer Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. This calculation is based on 160 per thousand and the first 500 is exempt.

How To Charge Your Customers The Correct Sales Tax Rates

The tax is paid to the county recorder in the county where the real property is located.

. Iowa Real Estate Transfer Tax Calculator Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid. To view the Revenue Tax Calculator click here. This feature is used to determine registration fees by vehicle identification number or by selecting make year and model.

The physical address is R Iowa Barn 44244 State Hwy 14 Chariton. Transfer Tax Tables 1991-Present Online Services. If you are a bank law firm or abstract company interesting in e-filing then we can help.

You can also find the total amount paid by entering the revenue tax stamp paid. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the.

The Calhoun County Recorders Office is part of the Statewide portal that provides index data for all 99 counties in Iowa. This calculation is based on 160 per thousand and the first 500 is exempt. Mindy Fitzgibbon County Recorder.

Department Home DNR Information Real Estate and Tax Inquiry Real Estate Transfer Tax Calculator and Documents Vital Marriage Records. Real Estate Transfer Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. What is Transfer Tax.

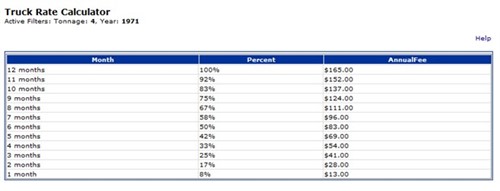

I just used Iowa Tax And Tags to pay the annual fee for my car. Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt.

You can also find the total amount paid by entering the revenue tax stamp paid. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Tax Rate The calculation is based on 160 per thousand with the first 500 being exempt. Calculate the real estate transfer tax by entering the total amount paid for the property. You can also find the total amount paid by entering the revenue tax stamp paid.

If you know the Year Make and Model key in Year Make and Model from the list displayed and press calculate. You may calculate real estate transfer tax by entering the total amount paid for the property. Total Amount Paid Must be 99999999 Rounded Up to Nearest 500 Increment - Exemption Taxable Amount x Tax Rate Tax Amount Due.

You can also find the total amount paid by entering the revenue tax stamp paid. Iowa Real Estate Tax tables Real Estate Transfer Declaration of Value and Instructions Recorders services Genealogy Information. 100 East Washington Street Suite 201 PO Box 106 Mount Pleasant Iowa 52641.

This calculation is based on 160 per thousand and the first 500 is exempt. Type your numeric value in the Total Amount Paid field to calculate the total amount due. Tax Calculator Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present This calculation is based on 160 per thousand and the first 500 is exempt.

This calculation is based on 160 per thousand and the first 500 is exempt. Recorder Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property. Calculate the real estate transfer tax by entering the total amount paid for the property.

The tax is imposed on the total amount paid for the property. Groundwater Hazard Form Attachment 1 Groundwater Hazard Form Instructions Updated 2012 Declaration of Value Form Real Estate Transfer - Groundwater Hazard Statement Updated 2012. To find out more information Click here.

This calculation is based on 160 per thousand and the first 500 is exempt. Real Estate Transfer Tax Calculator You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first 500 is exempt. Press TAB for results.

This calculation is based on 160 per thousand and the first 50000 is exempt. Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. This calculation is based on 160 per thousand and the first 500 is exempt.

Transfer Tax Calculator - Chickasaw County Iowa Clear 55 Veterans Affairs Commission Openings Learn More Apply RecorderRegistrar Transfer Tax Calculator Alert You can also find the total amount paid by entering the revenue tax stamp paid. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 500 is exempt.

Do not type commas or dollar signs into number fields. The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property. Calculate the real estate transfer tax by entering the total amount paid for the property.

Transfer Tax Calculator - Adair County Iowa Clear 41 Recorder Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

You can also find the total amount paid by entering the revenue tax stamp paid. Transfer Tax Calculator Iowa Real Estate Transfer Tax Description The tax is imposed on the total amount paid for the property. Transfer Tax Calculator - Recorder - Cedar County Iowa Recorder Transfer Tax Calculator Alert You can also find the total amount paid by entering the revenue tax stamp paid.

Monroe County Iowa - Real Estate Transfer Tax Calculator Real Estate Transfer Tax Calculator Enter the amount paid in the top box the rest will autopopulate.

Cryptocurrency Taxes What To Know For 2021 Money

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Megamillions Payout And Tax Calculator Lottery N Go

Transfer Tax In San Luis Obispo County California Who Pays What

Jackson County Iowa Real Estate Transfer Tax Calculator Jackson County Iowa

Transfer Tax Alameda County California Who Pays What

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Transfer Tax In San Diego County California Who Pays What

Monroe County Iowa Transfer Tax Calculator

Hawaii Sales Tax Calculator Reverse Sales Dremployee

Property Tax Calculator Casaplorer

Calculate Your Transfer Fee Credit Iowa Tax And Tags

What You Should Know About Contra Costa County Transfer Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags